In IMPULSO we understand consulting as the permanent search on behalf of our clients for the best financial and tax instruments, which can maximize their return both for investments of a productive nature, and for their energy efficiency or R&D+i projects. That is why we aspire to become strategic partners of our clients in everything related to obtaining public financing and improving business competitiveness through the best tax deductions and financial savings.

Our MISSION is to identify and obtain returns and savings that benefit our clients without changing their internal organization and simplifying procedures.

Our PHILOSOPHY is based on rewards for success, resulting from the benefits obtained by our clients.

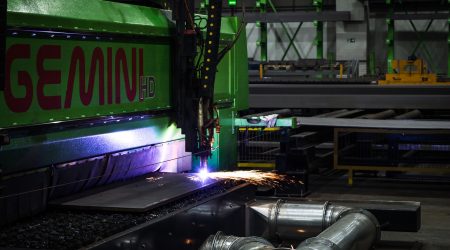

We are aware of the current need for companies to make profitable and obtain returns from their R&D investments, minimizing their financial impact and cost, and we assist them in the use of Spanish tax instruments and mechanisms to achieve this priority and strategic objective. The two axes on which our advice is based are the following:

PUBLIC FUNDING: “Public Funding”

Funding through direct subsidies or via a repayable loan is an excellent operational lever and a direct impetus available for companies to increase their competitiveness and improve their results. We look for the best instruments for our clients’ specific project and accompany them throughout the follow-up until the investment or technological innovation project achieves the best possible results, guaranteeing security, confidence and results. Tell us about your business investment project or your innovation project. We know how to listen carefully and guide you through the requirements of the different regional, national or European aid programs and incentives.

TAXATION: R&D TAX DEDUCTIONS “Tax Savings”

At IMPULSO we have extensive experience and knowledge in identifying the R&D+i processes of our clients and in the tax treatment of the expenses and investments associated with them, which allows us to offer global technical advice aimed at guaranteeing that our clients maximize their corporate tax savings. The deductions and rebates for R&D+i activities allow companies to recover about 59% of the investment made in R&D and 12% of the investment made in technological innovation. Although the deductible limit of the investment is 50%, deductions are accumulative as tax credit and applicable for 18 years. At IMPULSO we accompany you throughout the process of applying for this tax incentive.

Advantage:

- Immediate economic effect comparable to a subsidy.

- It can be requested by any company, regardless of the size or sector of activity.

- Proportional to spending on R&D or IT activities developed and compatible with other aids.

- It can be applied in subsequent fiscal years (up to 18 years).

- Possibility of benefiting from this incentive even when the company is losing.

- Legal security by obtaining a Reasoned Report from MINECO.